san francisco county sales tax rate

Presidio of Monterey Monterey 9250. The Narrows Restaurant Grasonville Md.

How Do State And Local Sales Taxes Work Tax Policy Center

1000000 or more but less than 5000000.

. The San Francisco County sales tax rate is 025. Has impacted many state nexus laws and sales tax collection requirements. Depending on the zipcode the sales tax rate of san francisco may vary.

The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco. The Sales tax rates may. Tree Of Life Drawing Therapy.

You can find more tax rates and allowances for San Francisco County and California in. Louis Missouri 5454 percent close behind. Proposition F eliminates the Citys Payroll Expense Tax and gradually raises the.

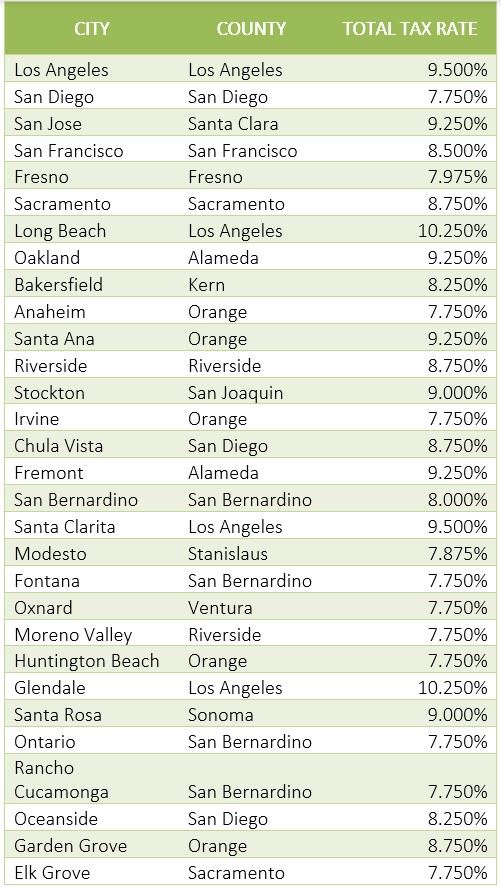

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Method to calculate San Francisco County sales tax in 2021. Soldier For Life Fort Campbell.

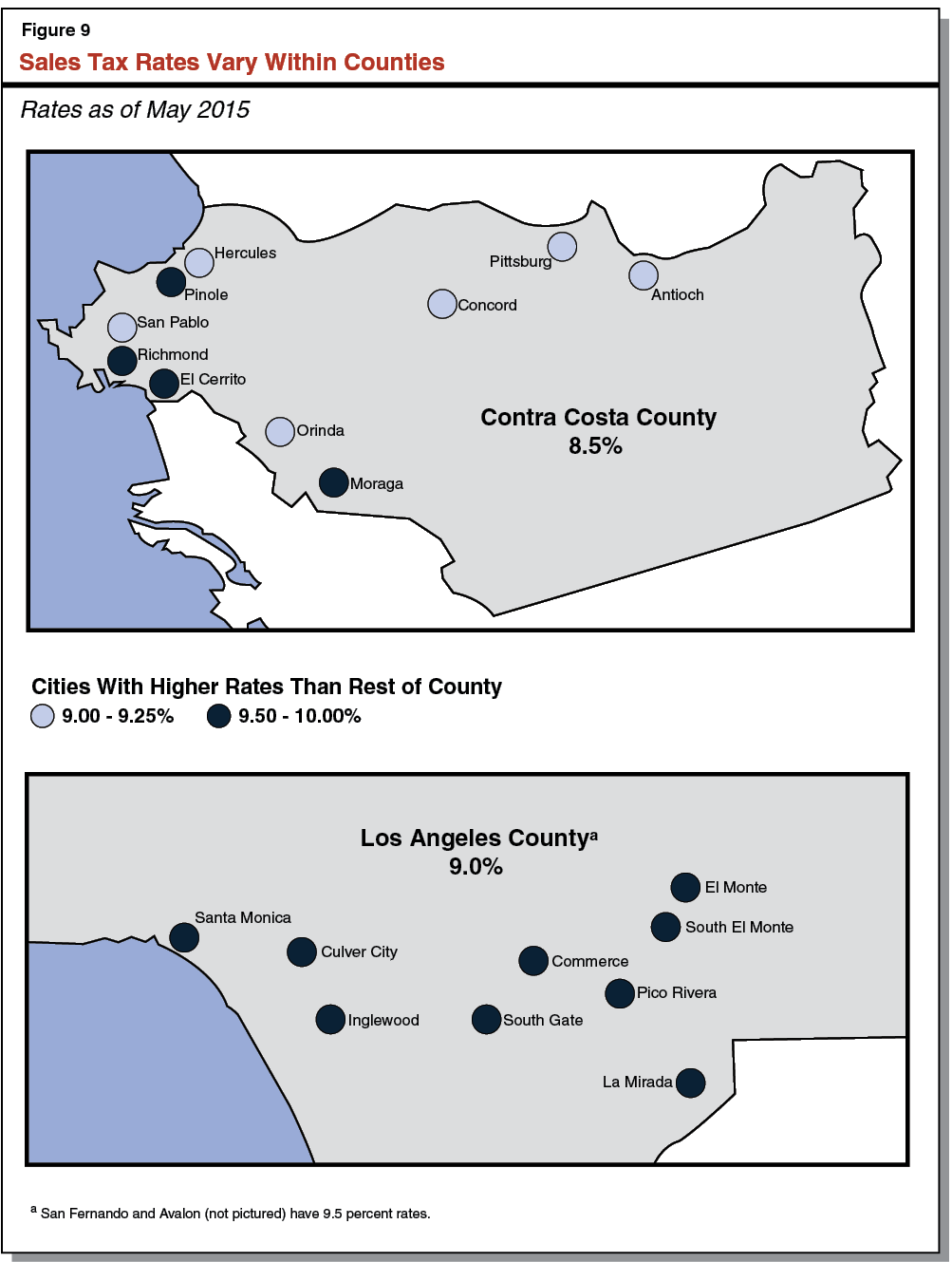

Typically the largest seller costs are brokerage commissions and transfer taxes. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. SAN FRANCISCO COUNTY 8625 SAN JOAQUIN COUNTY 775 City of Lathrop 875 City of Lodi 825 City of Manteca 825 City of Stockton 900 City of Tracy 825 SAN LUIS OBISPO COUNTY 725 City of Arroyo Grande 775 City of Atascadero 875 City of Grover Beach 875 City of Morro Bay 875 City of Paso Robles 875 City of Pismo Beach 775.

The tax rate given here will reflect the current rate of tax for the address that you enter. 340 for each 500 or portion thereof. Income Tax Rate Indonesia.

The minimum combined 2022 sales tax rate for San Francisco California is. The average sales tax rate in California is 8551. 6 rows The San Francisco County California sales tax is 850 consisting of 600 California state.

Opry Mills Breakfast Restaurants. More than 250000 but less than 1000000. The San Francisco sales tax rate is.

The San Francisco sales tax rate is 0. To review the rules in California visit our state-by-state guide. This is the total of state county and city sales tax rates.

San Francisco County Sales Tax Rate. Did South Dakota v. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

Offering the property at public auction allows the collection of past due taxes. Presidio San Francisco 8625. More than 100 but less than or equal to 250000.

The California sales tax rate is currently. Idea Of Www Fxstreet Com Rates Charts Live Charts Check More At Https Oakleys Sunglasses Top Douglas Gomez Www Fxstreet Com Rates Charts Live Charts 1580 Chart. A county-wide sales tax rate of 025.

San Francisco County Sales Tax Rate. Posted Tue May 10 2022 at 905 am PT. Majestic Life Church Service Times.

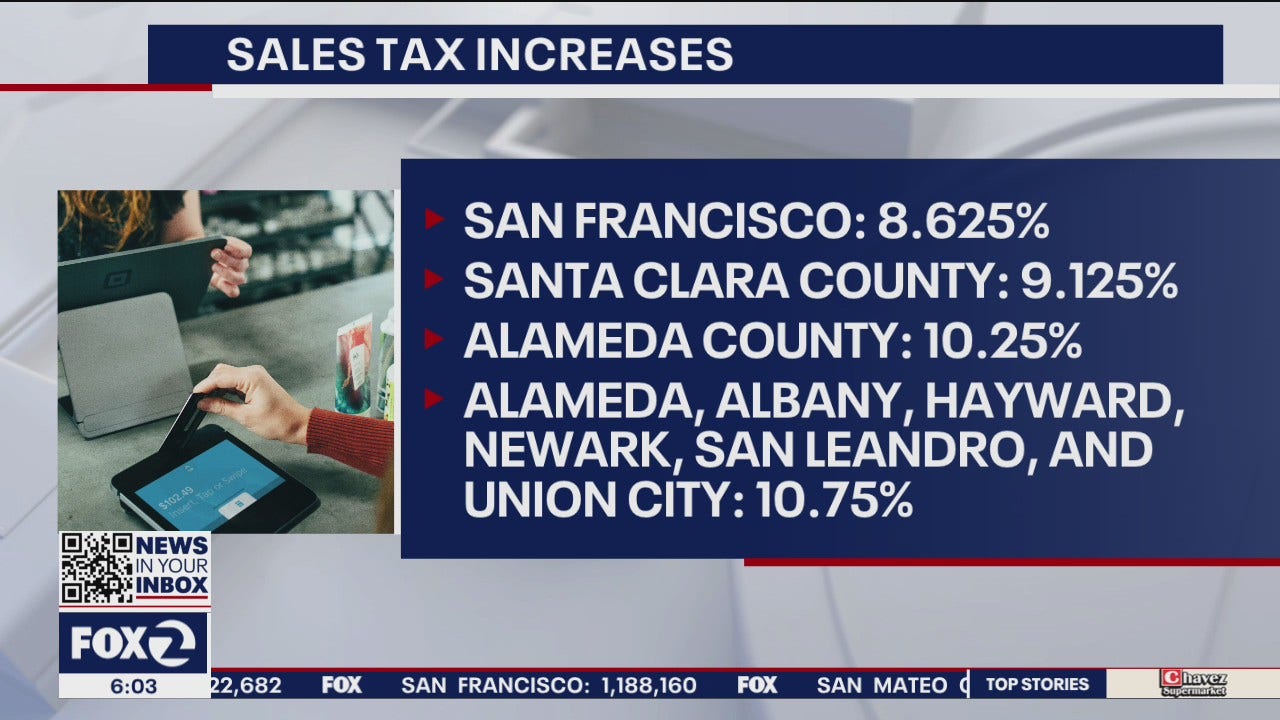

In San Francisco the tax rate will rise from 85 to 8625. The minimum combined sales tax rate for San Francisco California is 85. This is the total of state county and city sales tax rates.

Tax rate for entire value or consideration is. To examine the title location and desirability of the properties available to their own satisfaction prior to the sale. The San Mateo County District Attorneys Office is declining to press charges after reviewing reports from law enforcement.

6 rows The San Francisco County Sales Tax is 025. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. The County sales tax rate is.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. For sellers closing costs usually run in the range of 6 to 7 of the sales price not including loan pay-off and any significant home preparation staging or repair costs. Some businesses are also required to file and pay the Gross Receipts Tax and other annual taxes.

The South San Francisco California sales tax is 750 the same as the California state sales tax. Jeffrey Perkins Patch Staff. Here is the standard clause governing closing costs in the SFAR purchase contract Revise.

The County sales tax rate is 025. Wa Car Sales Tax Calculator. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1.

The primary purpose of a tax sale is to collect taxes that have not been paid by the property owner for at least five years. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax. The 2018 United States Supreme Court decision in South Dakota v.

San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco. 5 digit Zip Code is required. The California sales tax rate is currently 6.

250 for each 500 or portion thereof. 3 rows The current total local sales tax rate in San Francisco County CA is 8625. Essex Ct Pizza Restaurants.

Please ensure the address information you input is the address you intended. Restaurants In Matthews Nc That Deliver. Type an address above and click Search to find the sales and use tax rate for that location.

Bread Of Life Food Pantry Mitchell. What is the sales tax rate in San Francisco California. The Sales and Use tax is rising across California including in San Francisco County.

Click on a tax below to learn more and to file a return.

Sales Tax Collections City Performance Scorecards

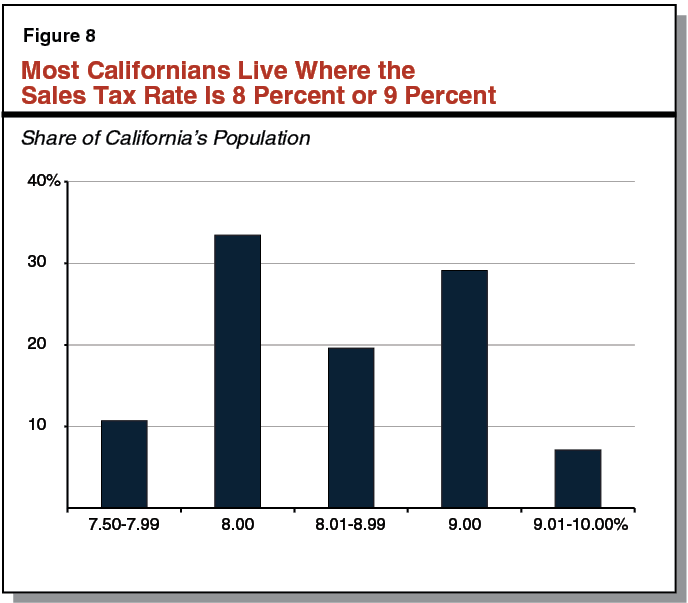

Understanding California S Sales Tax

States With Highest And Lowest Sales Tax Rates

California Sales Tax Rates By City County 2022

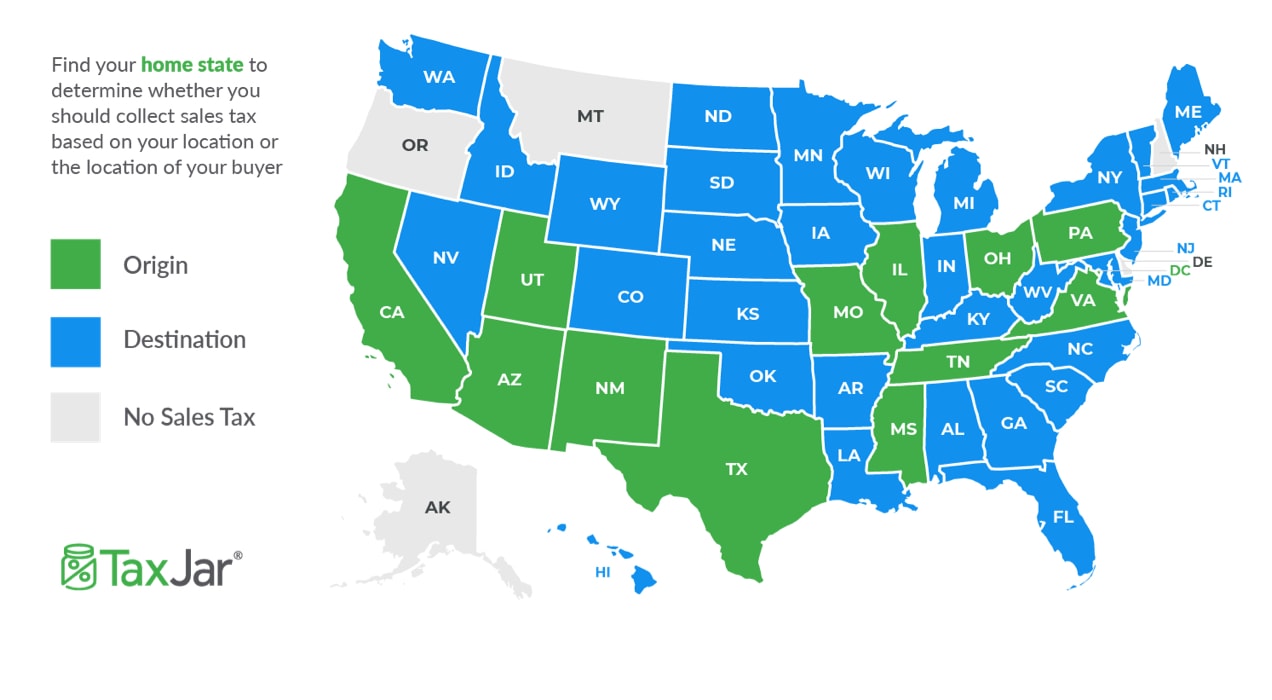

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

How To Calculate Sales Tax In Excel

California Sales Tax Small Business Guide Truic

Sales Gas Taxes Increasing In The Bay Area And California

Understanding California S Sales Tax

California Sales Tax Guide For Businesses

How To Calculate Sales Tax In Excel

Setting Up Tax Rates And Adjusting Tax Options

Understanding California S Sales Tax

How To Charge Your Customers The Correct Sales Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center